I’m lucky enough to have a plot of land in my garden and in the twenty odd years I’ve owned my house I’ve had plenty of ‘developers’ wanting to purchase it. Being a corner plot it’s ideally suited and other houses of a similar design have had this type of infill.

A few years ago my mother died and my father was left on his own to fend for himself. It made good sense, considering his age (now 90), that having him in the back garden would be the best thing for him and me. He does have various aliments, mostly age related, which means he does need a carer as his mobility and memory are quite bad.

Three years ago I hooked up with an architect and between us we designed a two-bed house for someone with mobility problems in mind.

Three years ago I hooked up with an architect and between us we designed a two-bed house for someone with mobility problems in mind.

The planning process seemed to take forever. I was aware of something called Section 106 which was a stealth tax on builders/developers but, due to it’s unpopularity (there’s a surprise), it was being replaced with Community Infrastructure Levy. I was led to believe that this was almost the same but as a self-builder I would be exempt.

Plans weren’t submitted until this system was adopted by Bournemouth Council which took some time. I’m led to believe that Councils didn’t want it and preferred Section 106 as it was a better revenue generator. The planning department were, to put it mildly, inept and planning was refused. This coming from a department that allowed the carbuncle that is the Hilton Hotel to be built in Bournemouth Square.

The architect, at his own expense, then went to appeal. A nice young man from the Planning Inspectorate came to visit the site and couldn’t see any reason not to grant planning permission and I was off.

This was at the beginning of 2017 and it took me 7 months to find a builder who could build it for what I could afford. In the meantime the architect was granted CIL exemption.

As a first time, and only time, self-builder I don’t have a clue about the workings of planning and rely on those who do.

My architect was originally employed to design and acquire planning permission for my house. Once this was achieved there was very little point in keeping him employed, after all, it’s only a traditional detached two bed house, the builder didn’t have a problem with the drawings and if there were any problems the architect was brought in when required, which wasn’t very often.

What I wasn’t privy to was that as far as the Council were concerned he was my ‘agent’ and therefore they would only deal with him, unless of course they wanted money, then they had no problem coming to me directly (parks and recreation, registering the address, rates etc). In the case of rates they even sent someone around.

It’s worth pointing out that what the council has done is legal and they are following their own, if not the governments, rules, however they do have a choice in who the correspond with. I’ve been told that many councils do communicate with both the architect and applicant on these matters. I’ll leave it to your imagination to guess why Bournemouth Council don’t.

Every year a government department called the Inland Revenue sends me a tax return, not my accountant or ‘agent’. I work on it with the accountant and I’m then responsible for submitting it. Eventually I get sent a bill which is duly paid. HMRC recognises that I’m responsible for completing my tax return, then why can’t Bournemouth Council have the sense to see their current policy regarding CIL liabilities is flawed?

Eventually building started and was going very well. Then in February 2018 I noticed, at different times during the same day, two ladies photographing the house (see photos). In one of those fateful moments I posted a comment on Facebook:

Two days later I posted:

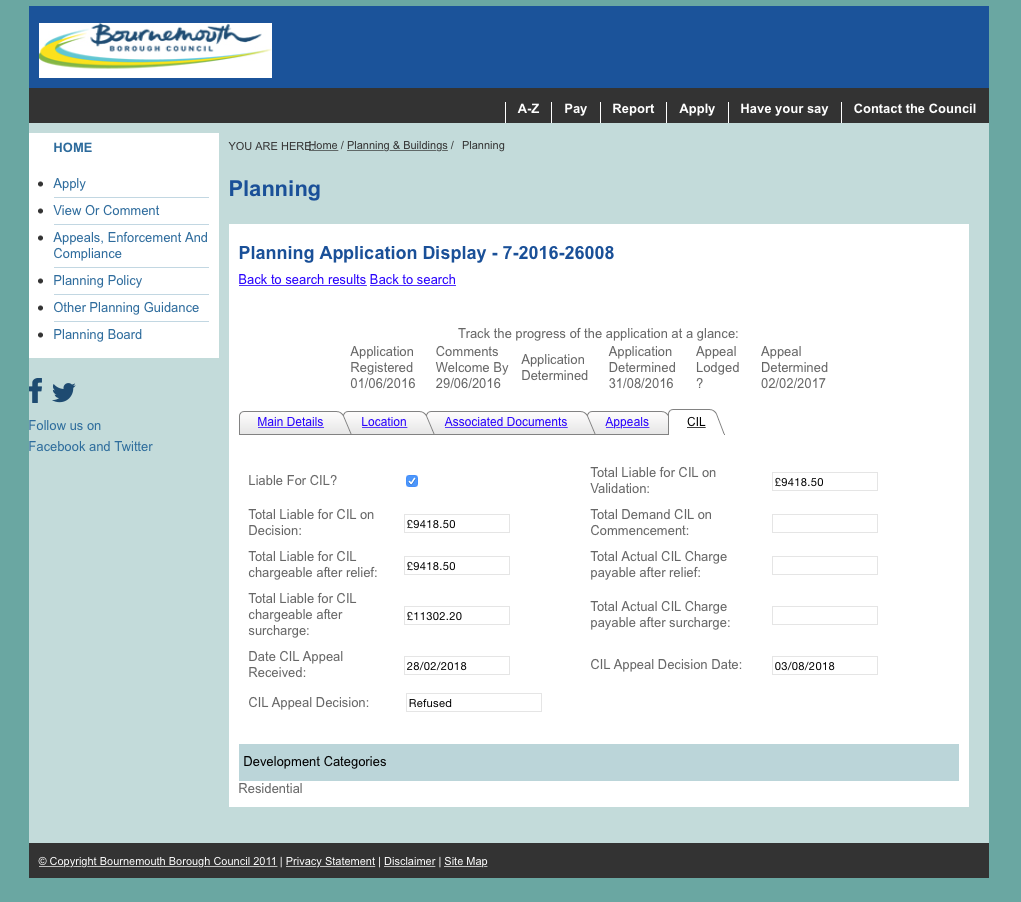

Here's an screen grab from Bournemouth Council's Planning Portal – it shows CIL contrubutions that are lower than the ones I evenually had to pay – £700 less! Is this another case of incompetency or milking it? Click to enlarge image.

A few days later the architect called me to ask if I had completed the CIL Commencement Notice of Development form prior to building. I hadn’t got a clue what he was talking about and he assured me that he’d sent me all the relevant documentation regarding this back in March 2017 (nearly a year ago). This was a very busy time as my father wasn’t long out of hospital and what with trying to work, find a builder and caring for my old Pops I was very busy. However, I couldn’t find anything.

I’m almost sure that if someone had said to me “fill in this form or you’ll have to give the council £12,000” it would have focused the mind and been completed very quickly and promptly sent it off.

Yes, you read that correctly – £12,000! £10,000 CIL charge and £2,000 fine for not submitting the form. Of course, the council don’t call it a fine they prefer to call it a surcharge.

I wrote to the CIL department at Bournemouth explaining that the Architect wasn’t employed back then and involving him wasn’t good practice and perhaps they should have sent me, or at least, both of us the paperwork back in March 2017. I even asked if there was something I could do retrospectively but they didn’t even respond to my letter.

This is how a conversation with the Council should have gone: “We can see how we’ve not been in direct contact with you Mr. Smith, and understand this could have been an issue. Fill out the forms now and we’ll back date them”. How much nicer would that of been? I’d be so lucky!

Let's assume on the day they sent my architect their emails he was run over by a bus – heaven forbid. These emails would sit on his server languishing unread forever if no one has his password to his email account (one man band in his case). Not an unreasonable hypothesis, these things can and do happen. I still would have been unaware of my CIL commitment until a bailiff appears on my doorstep months later as even the demand for money (ransom note) was emailed to him.

The CIL department at the council weren’t any more helpful with the architect and told him I had to appeal. It’s at times like this one finds the necessity to share and one friend who works in the building trade said it was hopeless “they’ve got you by the short and curlies”. And I’m not the only one:

Case one: CLICK HERE The guy was charged £24,000

Case two: CLICK HERE The applicant was charged £48,000

Sure enough I lost my appeal and had to pay a £12,000 demand – small in comparison to the above. I’m very tempted to take my father down to the council and leave him there, let's see how quick he runs up a £12,000 bill.

Not only am I helping the council reduce their housing quota but I'm also keeping someone out of one of their rest homes – perhaps they should be paying me!

CLICK HERE to download and read the Planning Inspectorate's decision here.

So, there you have it £12,000 for failing to submit a form entitled 'commencement notice' – crime of the century. It just tells them I'm about to start building my house. The council already knew this as the building control officer had told them, but apparently he deals with a different department, but still under the Planning Section. Council's for you.

Don’t expect anyone to have your back. The CIL system is not fit for purpose when it comes to the self-builder. Only communicating with a third party and not the person responsible for the build is inherently flawed. Councils should deal with the applicant/self-builder directly and they should send out reminders warning of the consequences. After all one becomes a self-builder to keep home ownership affordable and these ‘nice little earners’ for the council are a disgrace.

This calculator is base on Bournemouth's figures of early 2018 but is, apparently, set nationally. The current figure, based on my experience, is £73.87 per m2 as of early 2018. Enter your square meterage and see how much you'll have to pay if what happened to me happens to you! Please remember that what they post on their portal can be different to what you end up being charged, see 'Business Pratices' above.

Enter the square meterage of your new home

Bournemouth Council’s exemption letter is ambiguous. There are three parts that need completing, I’ve re-written it to make it clearer:

You will lose the right to relief if you do not comply with ALL the following:

(a) A commencement notice is not submitted to Bournemouth Borough Council before the chargeable development commences AND

(b) The claimant fails to submit Form 7: Part 2 within 6 months of completion of the chargeable development AND

(c) The claimant makes a material disposal of the property within three years of completion of the development

Notice the word ‘AND’ – Bournemouth Council use the word ‘OR’ and this can cause confusion as a cursory glance would give the impression that only one of the above needs to be complied with.

Check with your relevant council as no one knows what they are doing and each council might have different form names. Check the small print!

I’m now £12k down, this money would have allowed me to look after my father for a couple of years without having to work. Remember that it’s not within the Councils financial interest to give you exemption from CIL. Please don’t become a victim of this legal shady practice imposed by the very people employed to help us.

When I sent in my appeal the last paragraph read: "Whatever the outcome to this appeal I would strongly suggest that Bournemouth Council Planning Department should be encouraged to look closely at their policy of only dealing with architects especially when there’s a self-builder involved, if not for me but for other self-builders". It would be interesting to know whether this has been done.

If, by any chance, you're reading this and you work for Bournemouth Borough Council and take umbrage with anything mentioned above then you know what to do – write to my agent!

When the woman from the rates department came to have a snoop I found myself being a little curt. I did, after a while, apologise and I explained why I have a deep distrust of my local authority and its employees. I explained all the above to which she said “That seems a little unfair”. I couldn’t have agreed with her more and she works for the same lot.

20th June 2021

Here's an example of an understatement if I've ever heard one.

Must be bad when your own chief executive of BCP thinks his planning department is 'not very good'. Might be worth him looking into the practices of his CIL department too. Click here to read full story.

14th August 2018

The first time I've had direct contact with Bournemouth's CIL Department but, of course, they're only demanding money. That makes a change:

Dear Sir,

Following the attached appeal decision regarding the CIL surcharge applied to the above development, please note that the outstanding payment of £1,987.96 is due within 14 days of this email (28th August 2018)

If you have any queries concerning this matter, please contact me.

Kind Regards

(Name withheld)

Planning Contributions Officer

Planning, Transport & Regulation

'Kind regards'! It's a bit like a mugger thanking you after beating you up and stealing your money!

© Mark Smith 2025.